Moni

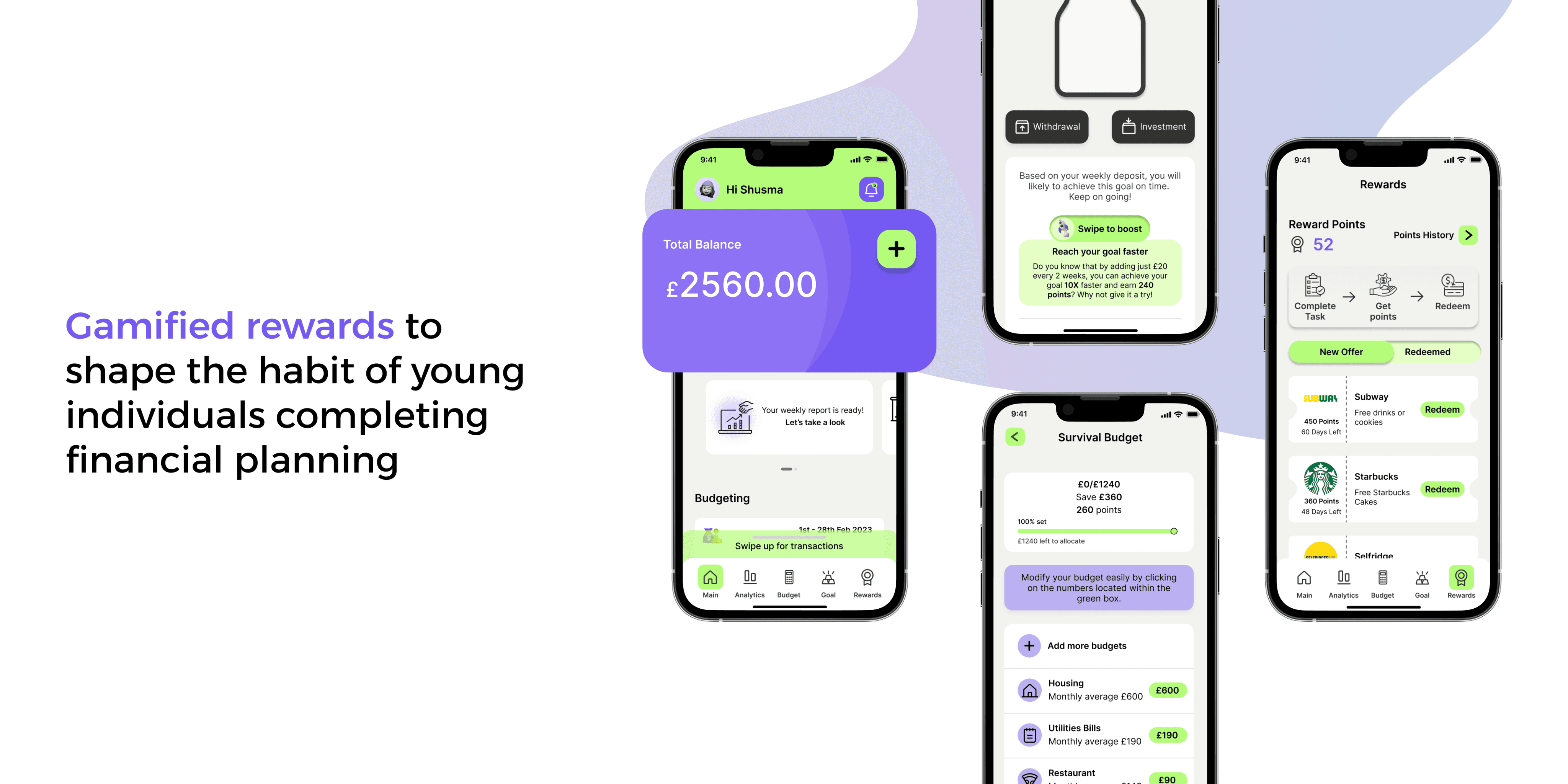

Moni employs game-based rewards to inspire users in achieving their budget plans and savings goals

My Roles

User Research

UI/UX design

Design Strategy

Prototype

Duration

Oct - Dec 2022

Design Team

Yuchen Zhang, Chingwen Lin

Tools Used

Figma

Miro

ProtoPie

Qualtrics

Google Meeting

What is our Product and How it works?

Utilising gamification for consistent financial planning engagement

Young people increasingly rely on fintech products for financial management, yet many struggle to remain committed. Moni tackles this challenge by employing gamified rewards to incentivise consistent usage of Budgeting and Goal-setting features, enhancing financial management optimisation.

Business Opportunity

Gamification greatly enhances customer retention and engagement in fintech products

The Mind over Money survey found that 77% of people experience financial anxiety. However, fintech apps face challenges, with 73% of new users leaving within a week, according to a recent report. Adjust data shows day 1 retention at 24% and day 7 at 17%.

Gamification involves applying game design techniques to non-game contexts to motivate users and enhance their experience. This strategy taps into the psychological need for achievement, rewards, and recognition to improve user engagement and long-term retention.

The benefits of gamification for fintech apps:

Improved user engagement

Increased retention, stickiness, and customer loyalty

Outcomes

83% of users affirm that rewards effectively drive them to fulfil their financial plans and goals.

Increased design speed by 16% by establishing an expandable

design system in Figma.

Approach

01 - Research

Background Research

Competitive Analysis

Interview

Affinity Mapping

User Personas

User Journeys

02 - Design

Brainstorming

User Flows

Information Architecture

Wireframes

Low Fidelity Prototype

03 - Evaluate

Usability Testing

User Feedback

Design Iteration

High Fidelity

Design System

Future Steps

Research

Initial Problem Discovery

Why is there a disconnect in intended and achieved financial plans/goals?

The Problem

People fail to accomplish their intended financial plans/goals as successfully as their achieved financial plans/goals.

Background Research

Primary users are young adults in the UK

A survey by HSBC found that 63% of young people in the UK are turning to apps and tools to help them save money and manage their finances, such as Monzo and Moneybox.

Use apps to

manage finances

63%

Fintech Amid 55% Future Concerns

A survey conducted by the Money Advice Service found that 41% of young adults in the UK (aged 18-24) have less than £100 in savings.

A survey by EY found that while 77% of millennials in the UK use Fintech apps, 55% said they were not confident about their financial future.

Less than

£100 in savings

Use Fintech apps

77%

Not

confident

55%

Competitive Analysis

The main functions in managing multiple financial institution accounts, budgeting and setting goals

Upon comprehending the problem, we researched the most prevalent Fintech Apps available in the market and assessed their respective functions, which helped us in extracting the key points of the problem from the model.

Monzo

Emma

Revolt

Starling

Questionnaire and Interview

55 participants answered the questionnaire, and 10 attended the one-on-one interview.

To determine the effectiveness of current Fintech apps in helping young people to save and manage their finances, we administered a questionnaire consisting of 30 questions to 55 participants who have used or intend to use such apps for this purpose.

To gain a deeper understanding of the questions, we further conducted one-to-one user interviews with additional 10 participants.

Q 1

Have you ever made a financial plan?

Yes

74%

Potential

20%

5.5%

No

Q 2

Did you achieve your financial plan?

“No️”

78%

🙆

Interview 1

Do you believe using fintech apps has helped you optimize their financial management?

Interview 2

What features or services do you typically use in fintech apps?

Interview 3

Have you encountered any problems or issues when using fintech applications for financial planning?

Interview 4

Is there anything specific you would like to see improved or added to existing fintech apps to help users optimize financial management?

Analysing the Data + Insights

Processing and Analysing the data 👀

55 participants who have used or intend to use Fintech apps to save and manage their finances

70+ data points

3 main insights

01 -

Frequently abandoning savings plans

People frequently abandon savings plans due to impulsive spending.

02 -

Complex budgeting process

People are frustrated by the tedious budget set-up steps due to the need for prior allocation of funds to each spending category.

03 -

Lack of continuous Incentives

Due to the lack of incentives, people find it difficult to stick to financial management Apps.

User Persona and User Journeys

Meet Ian

Based on our insights and observations from the research methods, we created two personas and user journeys that captured our users' essence and characteristics.

The initial character, Ian, is a supply chain manager attempting to leverage Fintech products for personal savings targets. However, a dearth of sustained perseverance and motivation leads to a recurrent pattern of abandoning these saving aspirations prematurely, primarily due to impulsive expenditures.

Meet Berry

Berry, the second character, grows weary of his haphazard spending tendencies and endeavors to utilize Fintech tools for structuring a budget. Regrettably, he consistently relinquishes this budgeting pursuit, primarily due to his uncertainty in allocating the budget effectively and his deficiency in sustaining motivation.

How might we improve the motivation to manage the financial plans for people?

Design

Testing Design Concepts

Setbacks😮💨 and New Direction for financial motivation

At first, we spent 1 week trying to play with 3 directions to improve financial motivation.

Educational Resources

AI to streamline

Gamification to motivate

Brainstorming theApp Design

Catering towards 3 main flow

Customized approaches were created to tackle unique challenges faced by different groups, as seen in Ian and Berry's cases.

We designed the goal acceleration feature to help impulsive spenders save more by boosting their motivation. For those struggling with budgeting, we used AI tools to reduce giving up.

To maintain user motivation and dedication to saving and budgeting goals, we set up a continuous reward system that consistently measures and enhances their motivation.

01 - Ian

Accelerated Savings Plan

Provide users with an interactive experience that enhances their motivation to save

02 - Berry

Quick Budgeting with AI functions

Generate personalized budget plannings for users that fits their specific needs

03 - Ian + Berry

Rewards Incentives

Provide users reward points that can be redeemed for products once they meet their saving goals and budget plans

User Flow

Wireframes

Solution

Final Solution + Design

01 - Ian

Savings accelerator to achieve goals faster

•

Provide goal acceleration to give users more incentive to accomplish their goals

•

Experience a vivid and visually appealing representation of savings through a money pot

02 - Berry

Personalised budget plans easily created in seconds!

•

Leverages AI to automatically generate the most appropriate budget for each category, based on users' daily expenses

•

Track spending for each budget category and provides corresponding notifications for each category

03 - Ian + Berry

Redeem rewards for achievement of Budgets and Goals

•

Earn points for each goal and budget achieved

•

Redeem Points for vouchers

•

Allowing users to be more confident and motivated to achieve each Goal and Budget

Evaluation

Testing and Improvement

3 Main Improvements to the Design

We conducted the usability test with the low-fidelity prototype with 5 participants and asked them to complete the same three tasks. We asked them to go through different scenarios in our prototype to garner enough feedback for our next design iterations.

Design System

Colour

Fonts

Header 20 pt, Semi bold

Large Text 16 pt, Semi bold

Large Text 16 pt, Regular

Medium Text 14 pt, Semi bold

Medium Text 14 pt, Regular

Small Text 12 pt, Semi bold

Small Text 12 pt, Regular

Icons

Future Steps

If I have more time……

•

Explore further the boundaries of financial management for young people.

•

See the different incentives available to motivate young people to manage their money and further research on how to develop young people's financial thinking and habits.

•

If we had more time, we would love to conduct an in-depth usability study with young people from a variety of occupational and educational backgrounds and track how well the prototype brings young people up on financial planning incentives over time.

•

Better adhere to WCAG standards.